Get Audit-Ready Before the New Year!

Join the Tax Pro Due Diligence Bootcamp & Holiday Brunch — In Person

December 4–5, 2025 | Atlanta, GA

Sonesta Atlanta Airport North

1325 Virginia Avenue, Atlanta, GA 30344

$699

$499

They’re Fining Tax Pros Left & Right

Don’t Let It Be You.

If the IRS walked into your office today, would your files pass a Due Diligence examination?

Most tax professionals think they’re compliant—until they’re audited. The truth is a lot of what’s being taught about Due Diligence is surface-level or just plain wrong. That’s why I created this in-person bootcamp: to teach you the real strategies my team and I have used to pass 8 IRS Due Diligence exams with ZERO fines.

Who This Bootcamp Is For

This 2-day event is for tax professionals who are serious about becoming IRS-compliant, protecting their business from penalties, and learning how to create bulletproof systems — all while connecting with like-minded pros over a stylish brunch!

Find the perfect program for you—click the button below!

What You’ll Walk Away With:

In-Depth IRS Due Diligence Training

Learn exactly what the IRS is looking for, how to document your files, and how to protect your business like a pro.

Real Examples & File Reviews

You’ll see sample notes, questions, and documentation that actually pass IRS review because they already have.

Step-by-Step Systems

Get my exact Due Diligence process so you can stop guessing and have all your clients’ files due diligence compliant.

Certificate of Completion

Leave with proof of your training and knowledge.

What You’ll Learn

Master Tax Pro Due Diligence Requirements

ERO Compliance & Your Role as a Business Owner

How to Avoid IRS Audit Triggers

Client Documentation Best Practices

Building a Compliance Workflow for Your Office

Real Examples & Case Study Breakdowns

Event Highlights

Hands-On Training

Interactive Workbooks and Materials

Networking Brunch

Live Q&A Sessions

Professional Headshots Available

(Optional Add-On)

Exclusive Bonuses and Templates

Day 1

Hands On Training

Day 2

Networking Brunch

Closing Panel

You Might Have Seen Me On

Event Schedule

DAY 1

Tax Pro Due Diligence Bootcamp

Thursday, December 4, 2025

Registration opens at 9:15 AM

1-hour lunch break (lunch on your own)

DAY 2

Holiday Brunch & Compliance Panel

Friday, December 5, 2025

Includes Brunch + One Mimosa

Meet other tax pros, enjoy a festive brunch, and hear real stories from those who’ve gone through Due Diligence and ERO compliance reviews. You’ll also create content, connect with peers, and leave with more clarity than ever.

MEET THE SPEAKER!

Dr. Gwennetta Wright

8-Figure Tax Business Owner.

40x Award-Winning Tax Coach. IRS Due Diligence Expert.

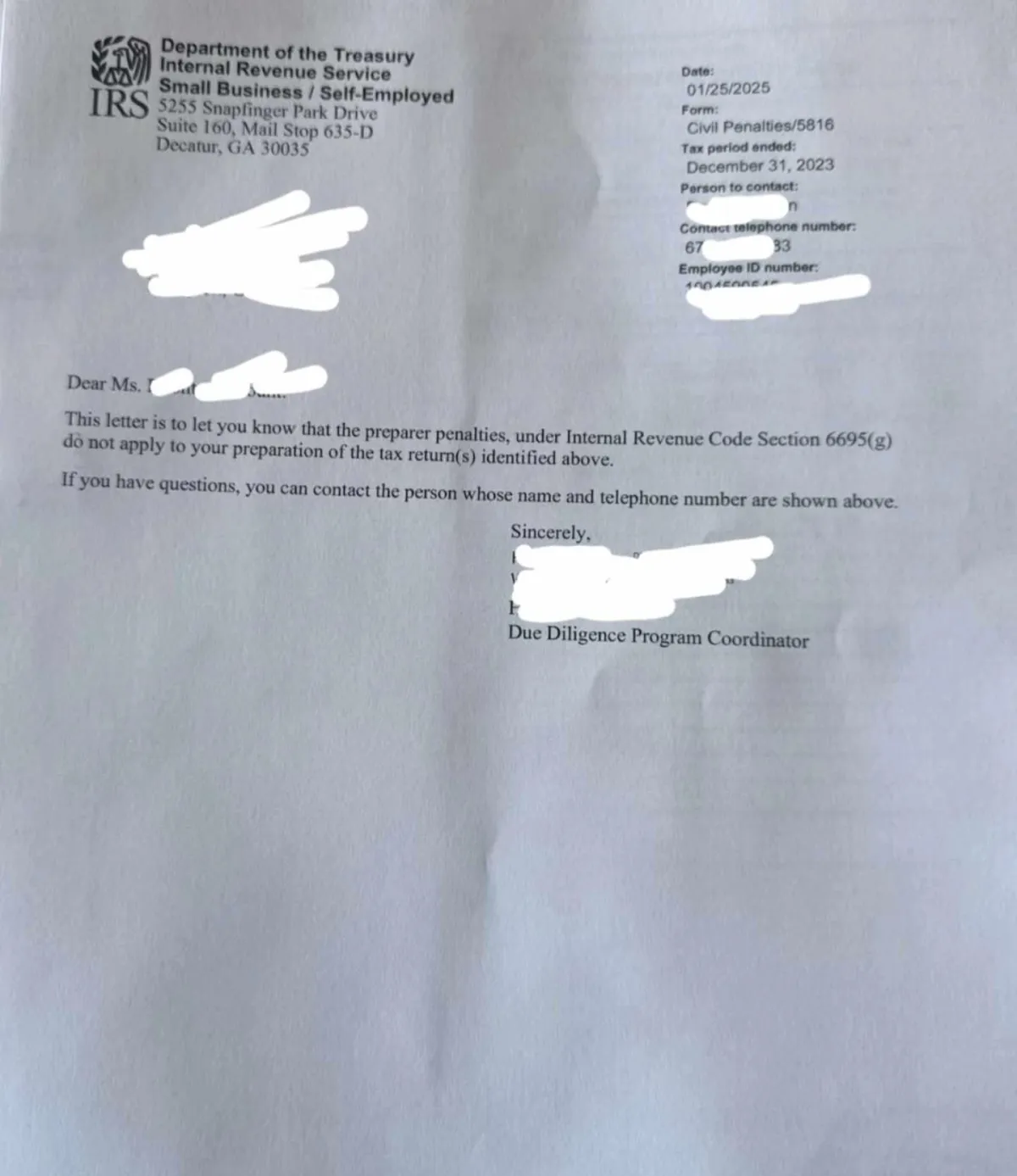

With nearly 20 years in the industry, Dr. Wright has not only trained thousands of tax professionals, she’s also personally faced and passed 8 Due Diligence exams with zero fines. When the IRS tried to issue a $47,000 penalty to one of her PTIN holders, she handled the appeals and got it reduced to zero. Now, she’s sharing the exact strategies that saved her business and can protect yours too.

This Training Could Save You $30,000 – $50,000 in IRS Penalties

Don’t wait until it’s too late. Due Diligence fines are real and they’re happening every day to tax professionals who “thought” they were doing it right.

Learn from someone who’s been through it and won.

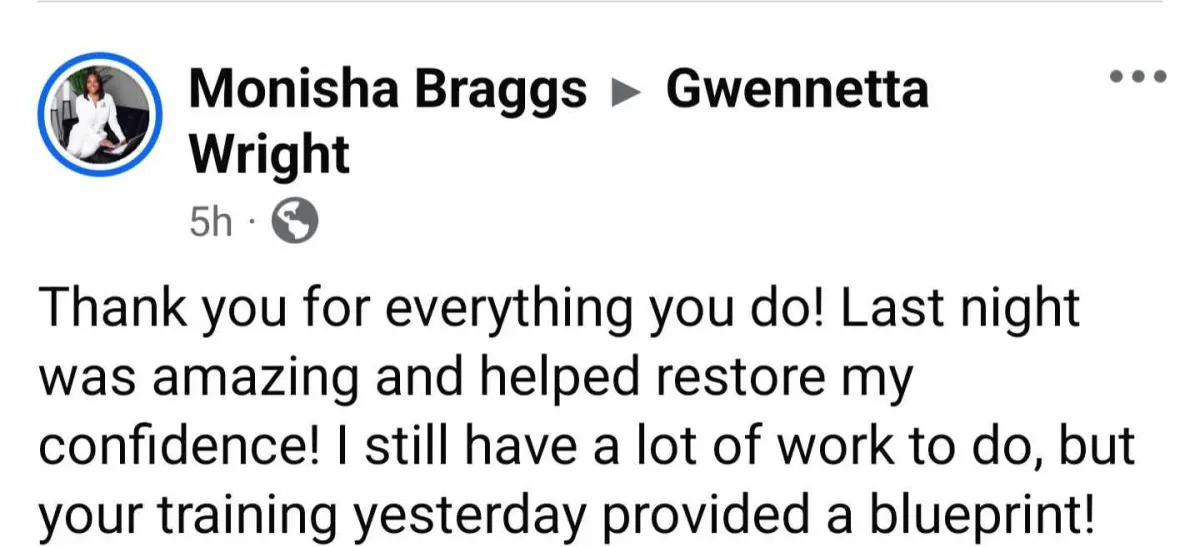

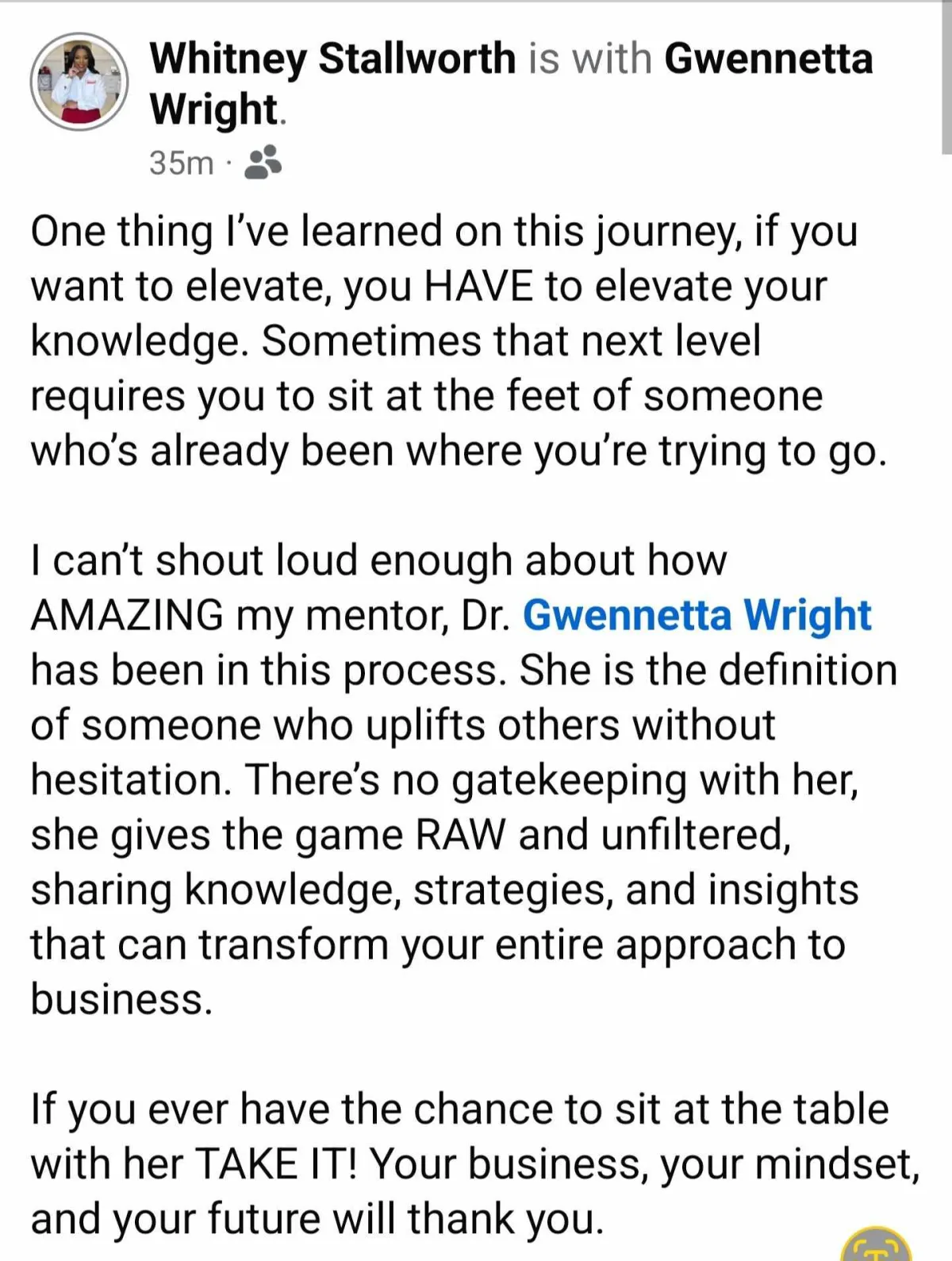

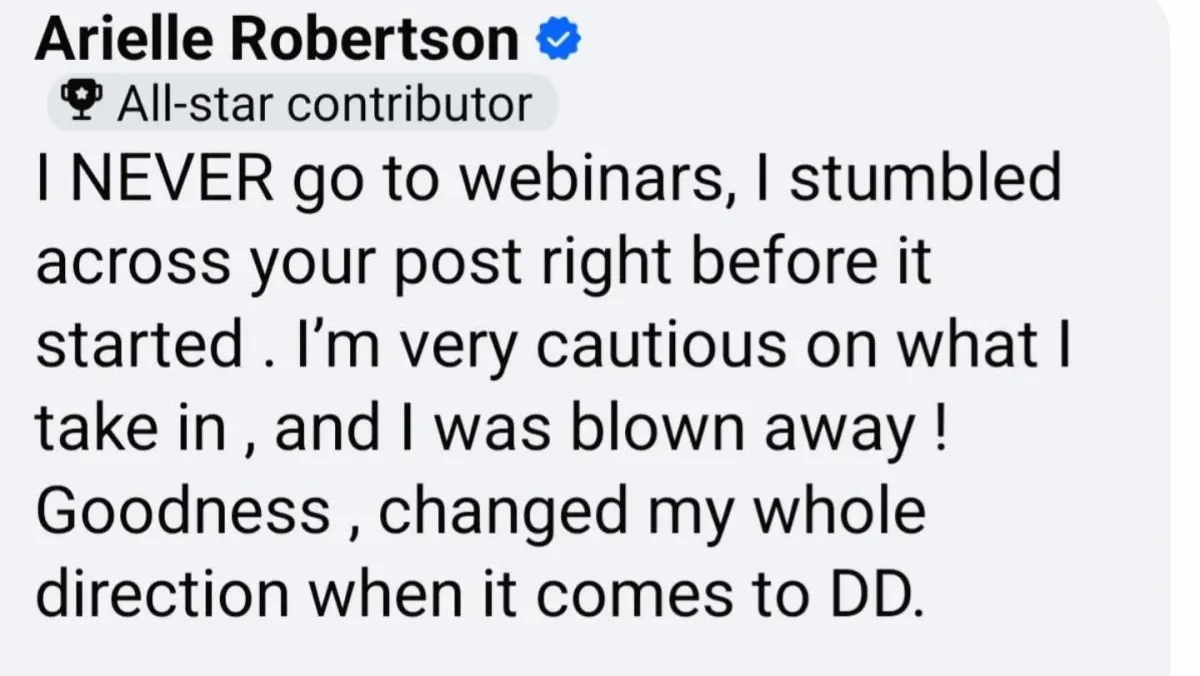

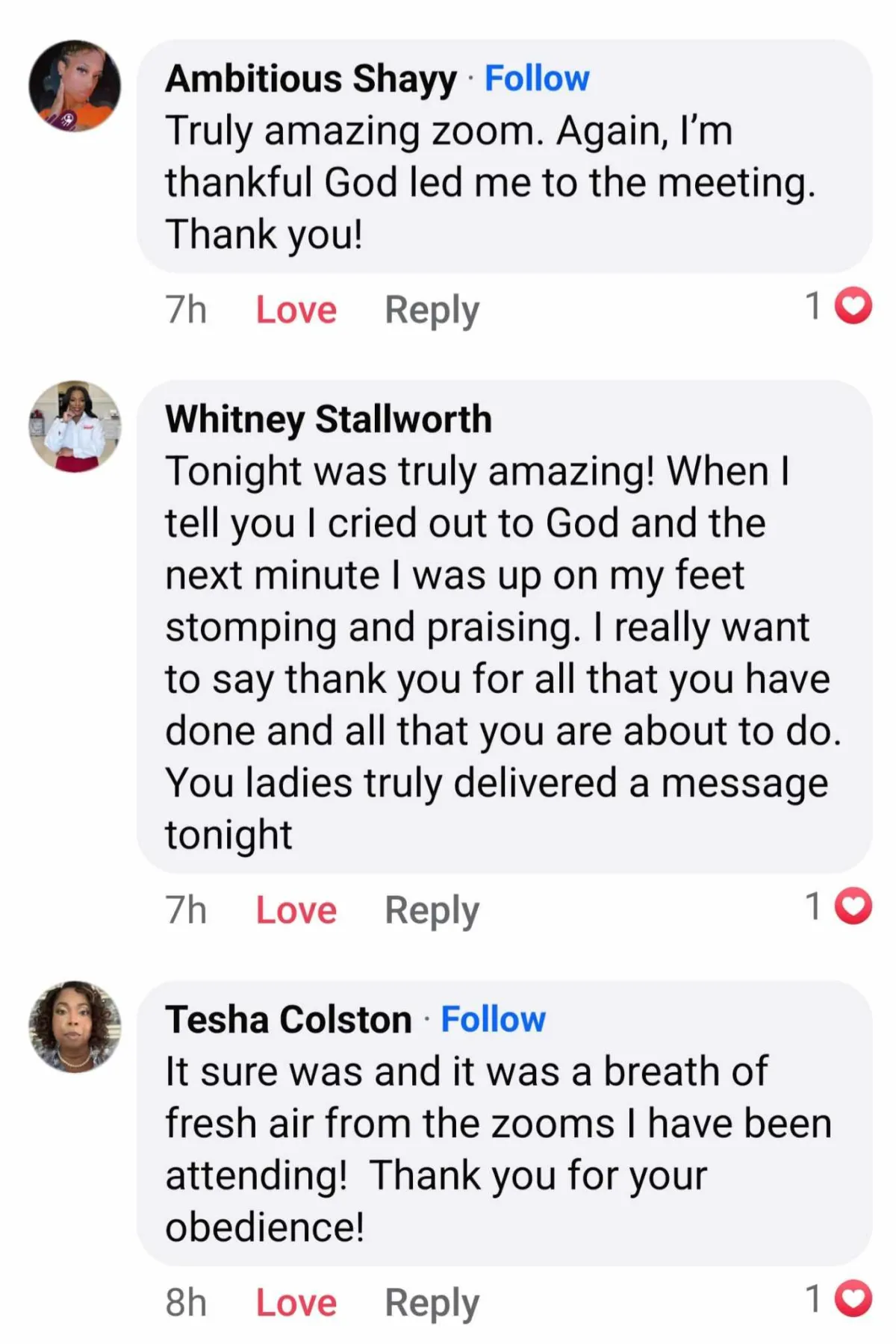

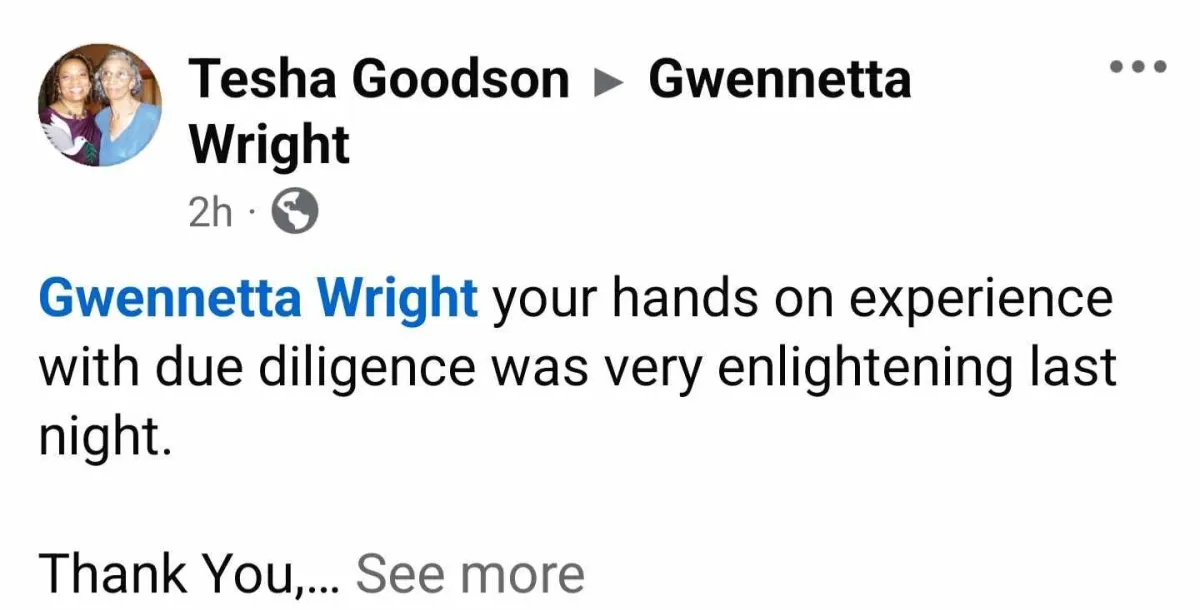

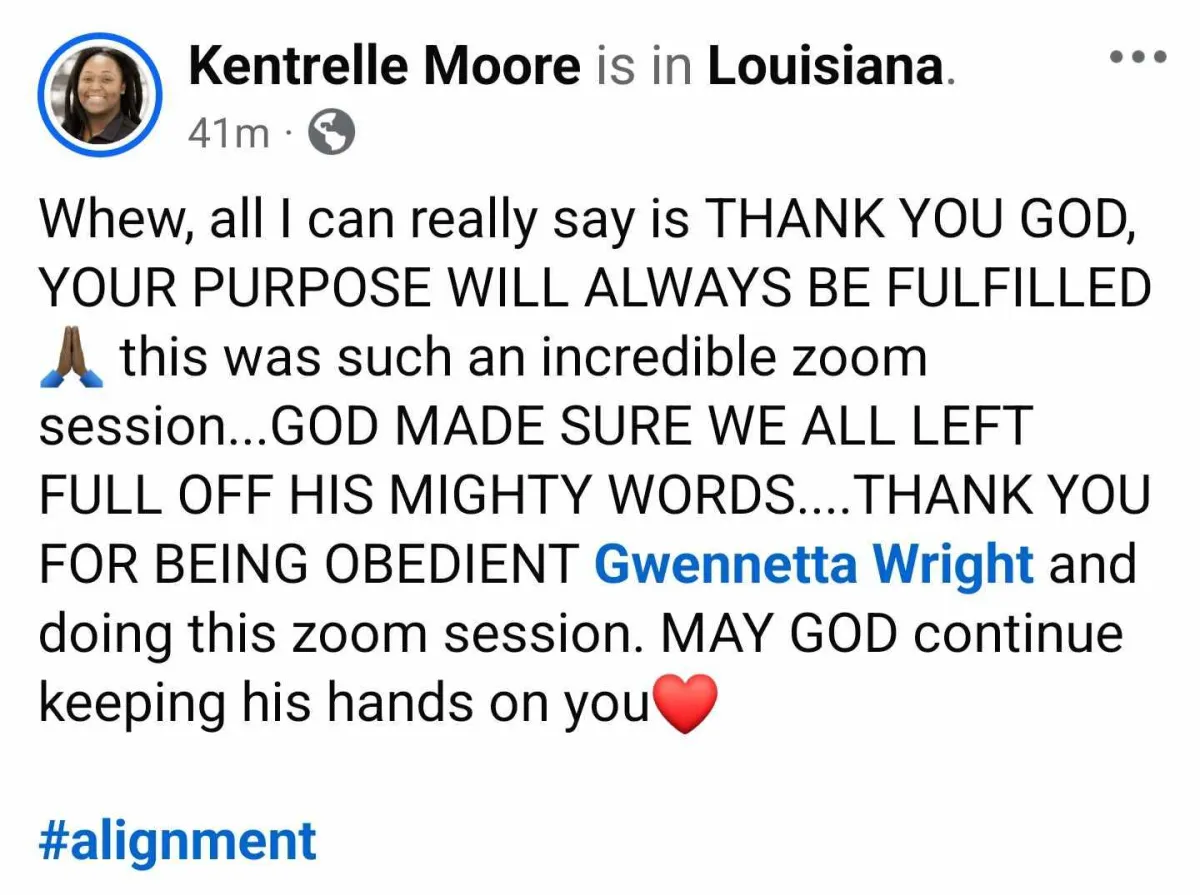

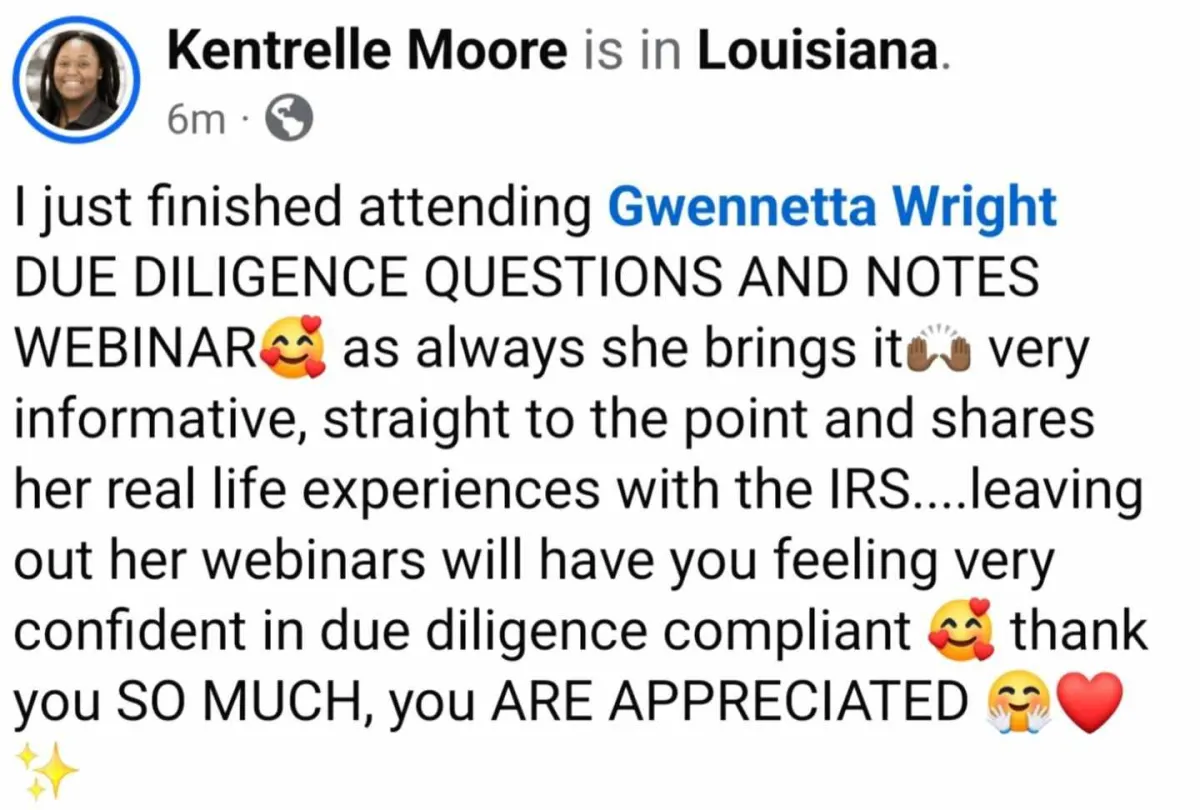

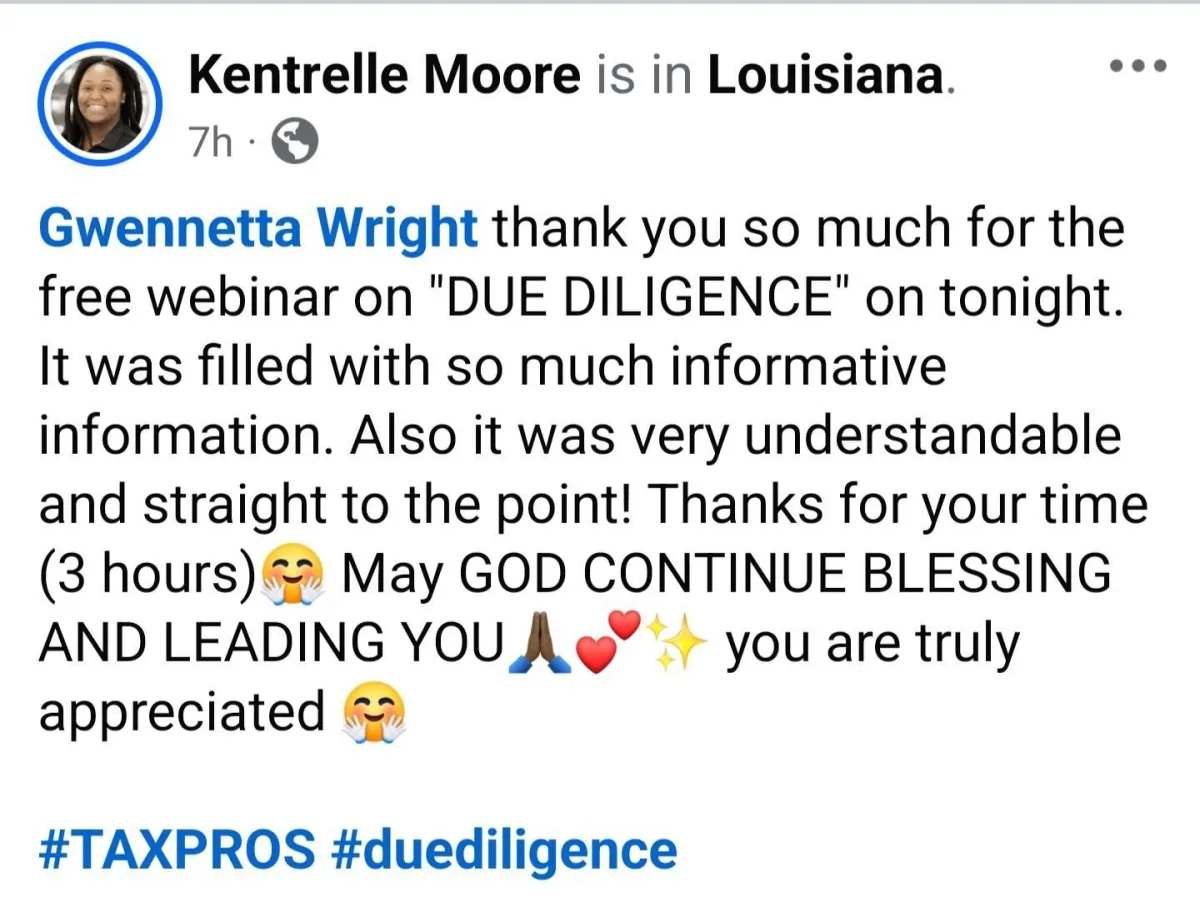

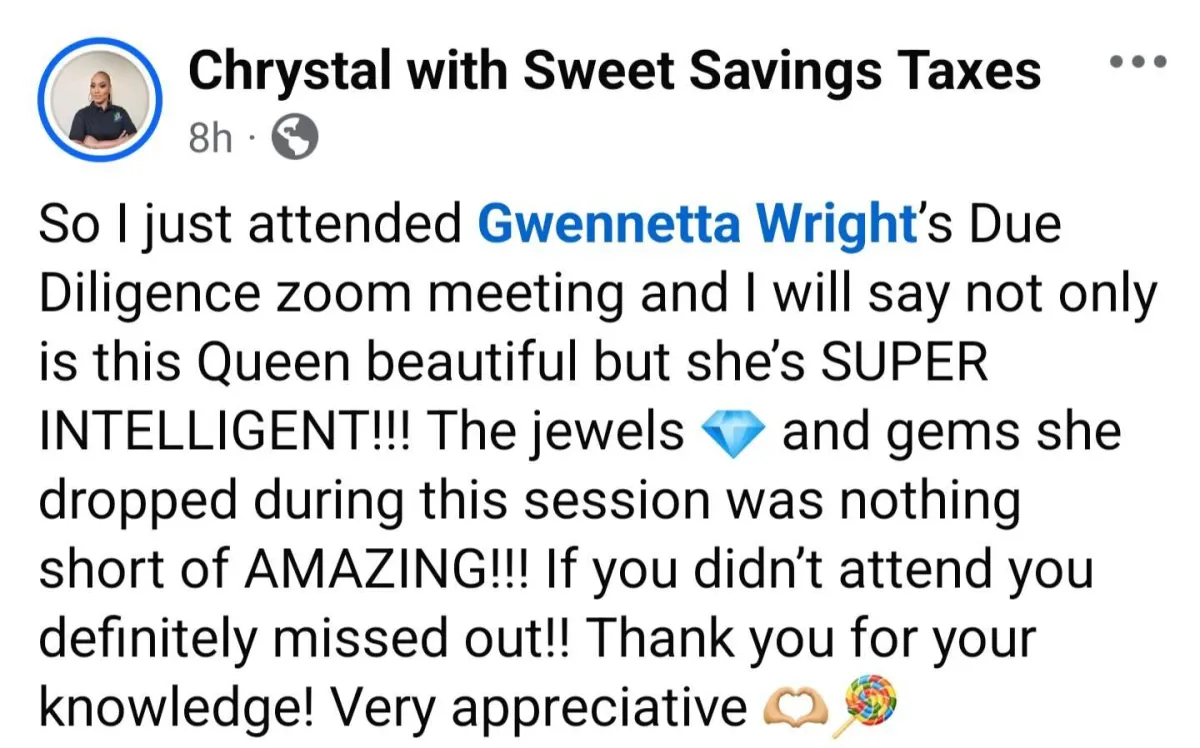

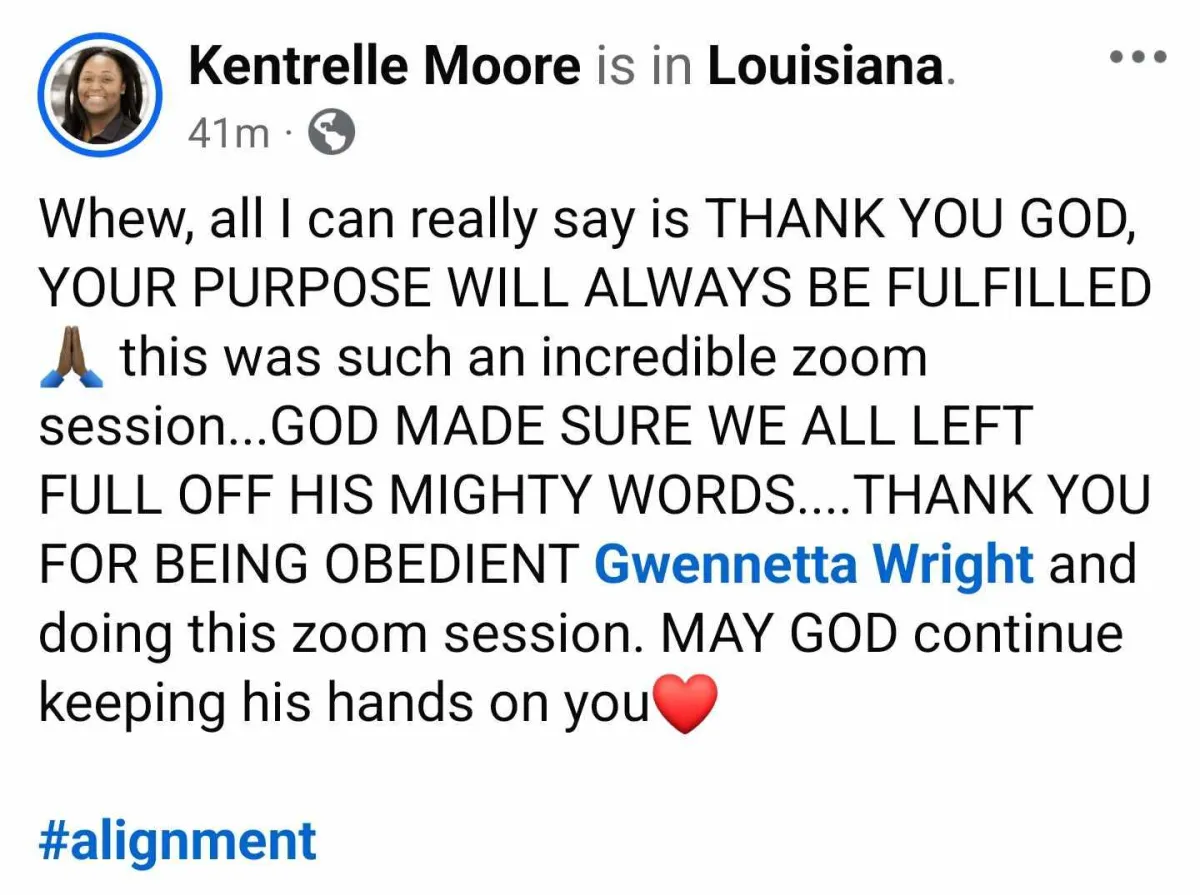

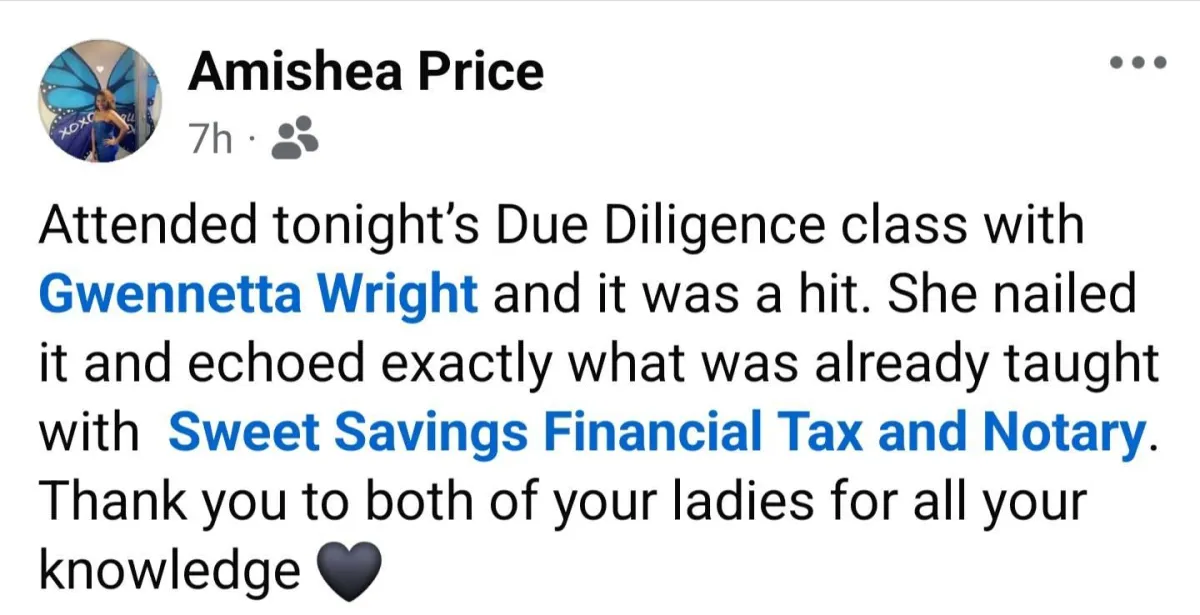

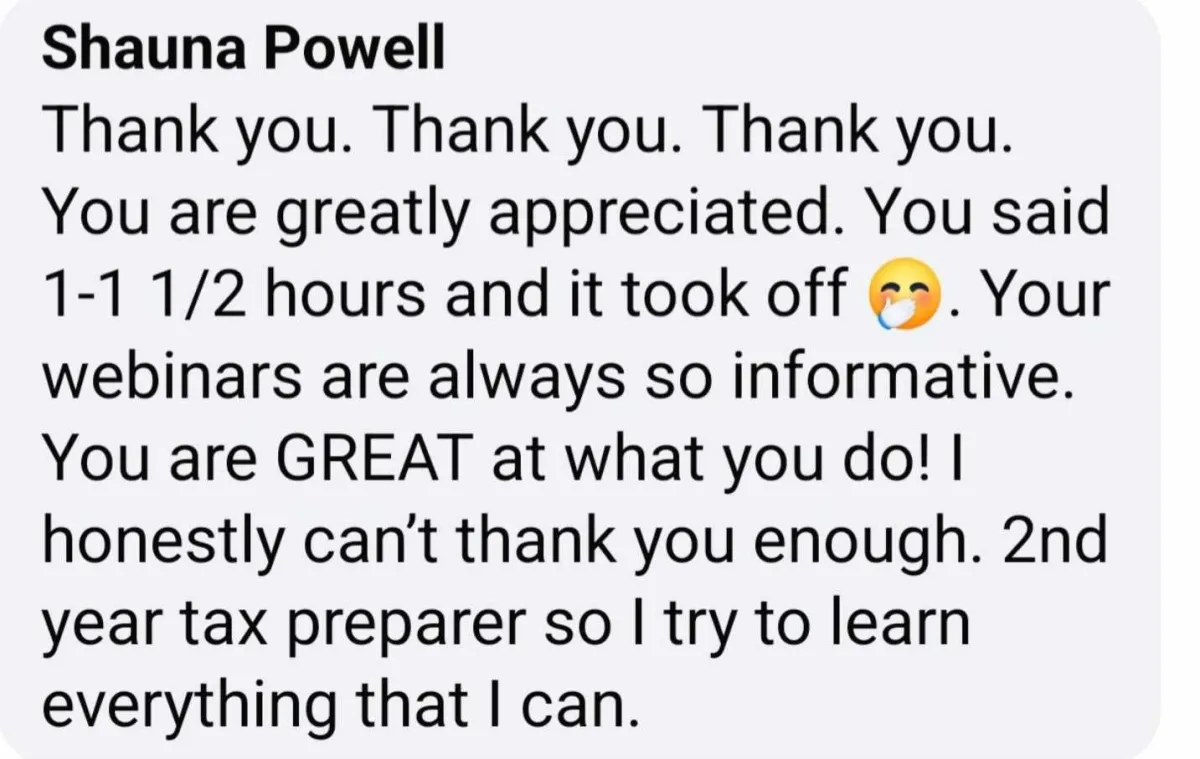

TESTIMONIALS

What others are saying

"Simply the best!"

You really did your big one! The best one I've been to so far

- Monisha Braggs

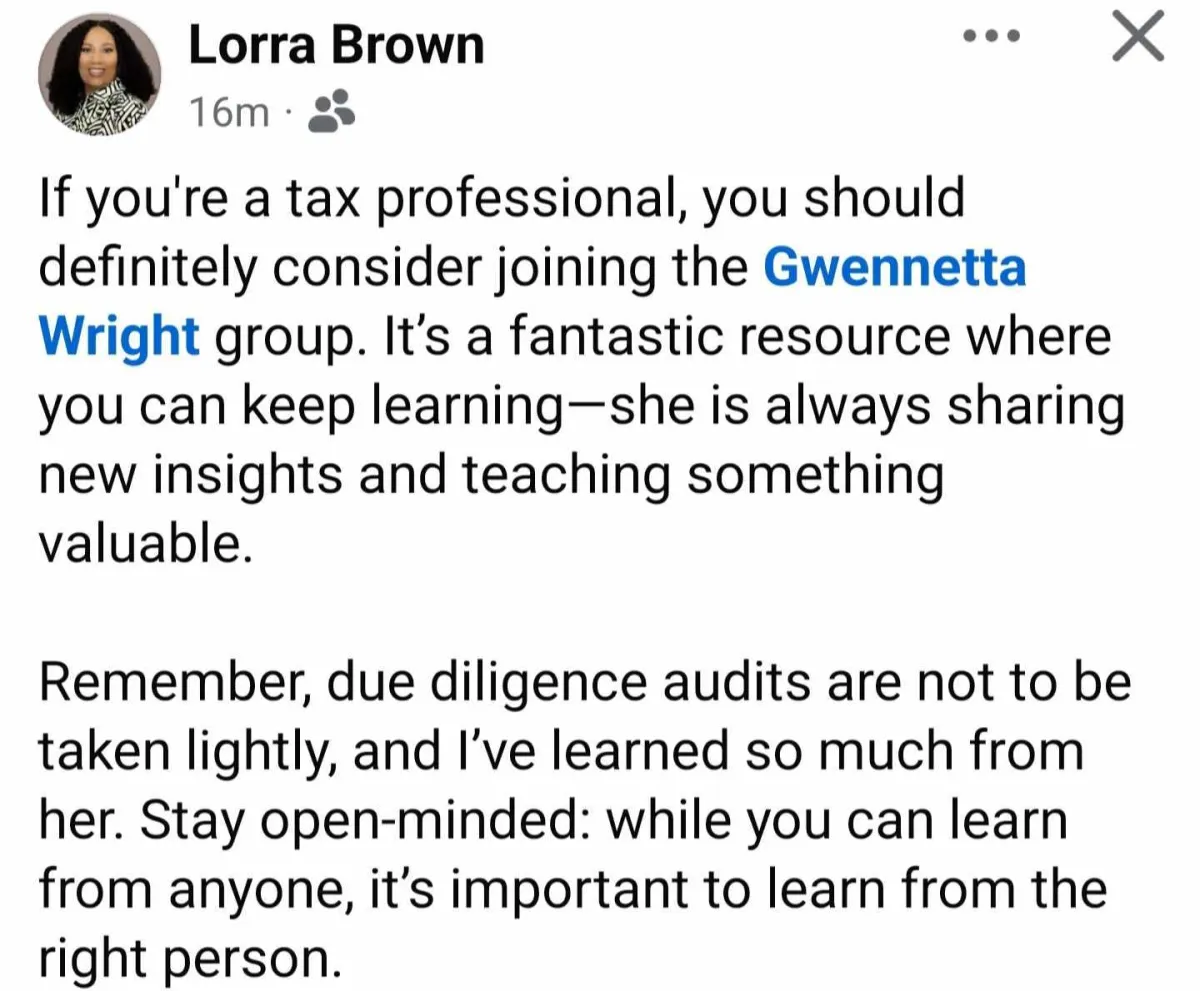

"I've learned so much from her."

If you're a tax professional, you should definitely consider joining the Gwennetta Wright group. It's a fantastic resource where you can keep learning-she is always sharing new insights and teaching something valuable. Remember, due diligence audits are not to be taken lightly, and I've learned so much from her. Stay open-minded: while you can learn from anyone, it's important to learn from the right person.

- Lorra Brown

"Deepened, Grateful, Inspired"

I have never learned as much as I did during this boot camp thank you so much for pouring into us.

- Lisla Wesley-Bryant

This Bootcamp Is For You If:

1

You’re a tax pro who wants to avoid fines and stay IRS-compliant.

2

You’ve been audited before or are scared you might be.

3

You’re tired of surface-level training that doesn’t prepare you for the real thing.

4

You want to feel more confident and in control of your tax files.

5

You’re ready to invest in your peace of mind before the next tax season hits.

Learn From A

7-FIGURE TAX PRO

About Dr. Gwennetta Wright

Dr. Gwennetta Wright is a 40x-award-winning tax professional, tax coach, and founder of Xpert Tax Service — an 8-figure tax business built on integrity, education, and compliance. With over 20 years of experience, she’s trained hundreds of tax preparers to build profitable, IRS-compliant businesses.

Dr. Wright and her team have successfully gone through 8 IRS Due Diligence examinations — and passed each one with zero fines. But the journey wasn’t without obstacles. Out of those 8 audits, they were fined twice: once for $47,000 and once for $6,000. Through her knowledge, documentation, and persistence, she fought both fines on her own, with no representation, and got them reduced to ZERO.

In this Tax Pro Compliance Bootcamp, she’s pulling back the curtain to teach you how to protect your business, stay audit-ready, and fight IRS fines — so you can run your business with confidence and peace of mind.

"If I can fight the IRS and win on my own, I can teach you how to avoid the fight altogether."

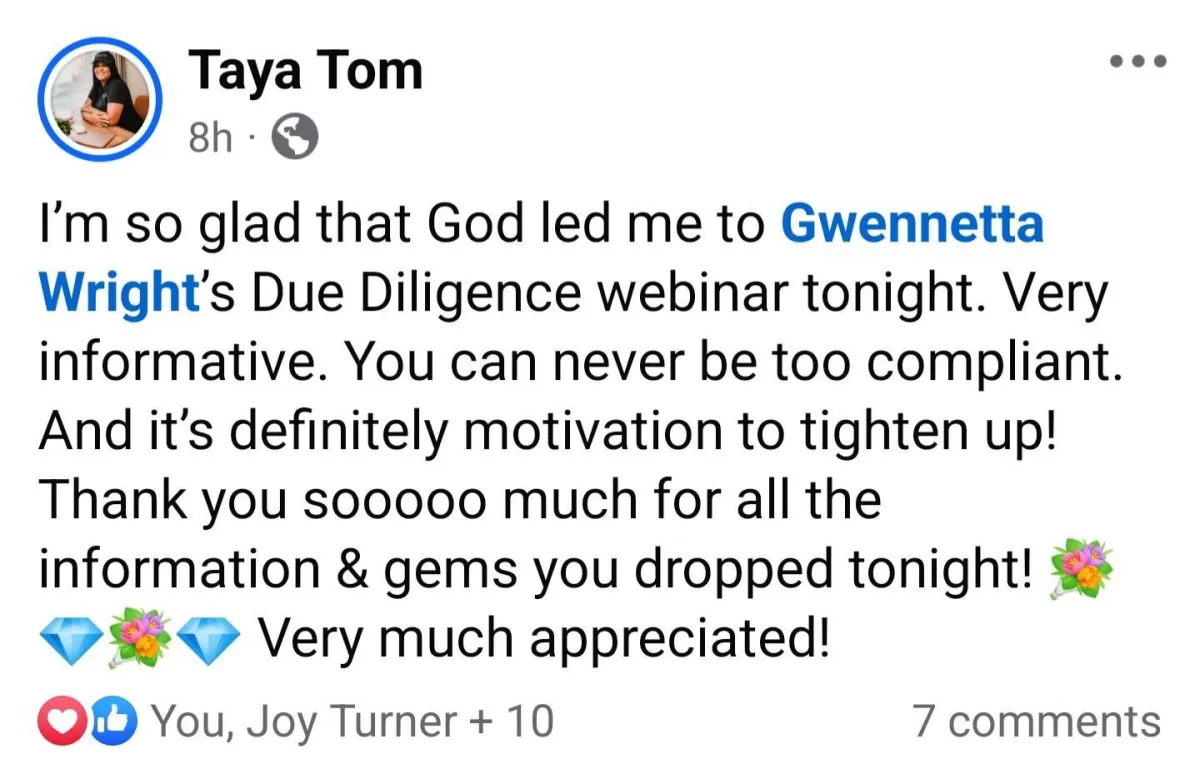

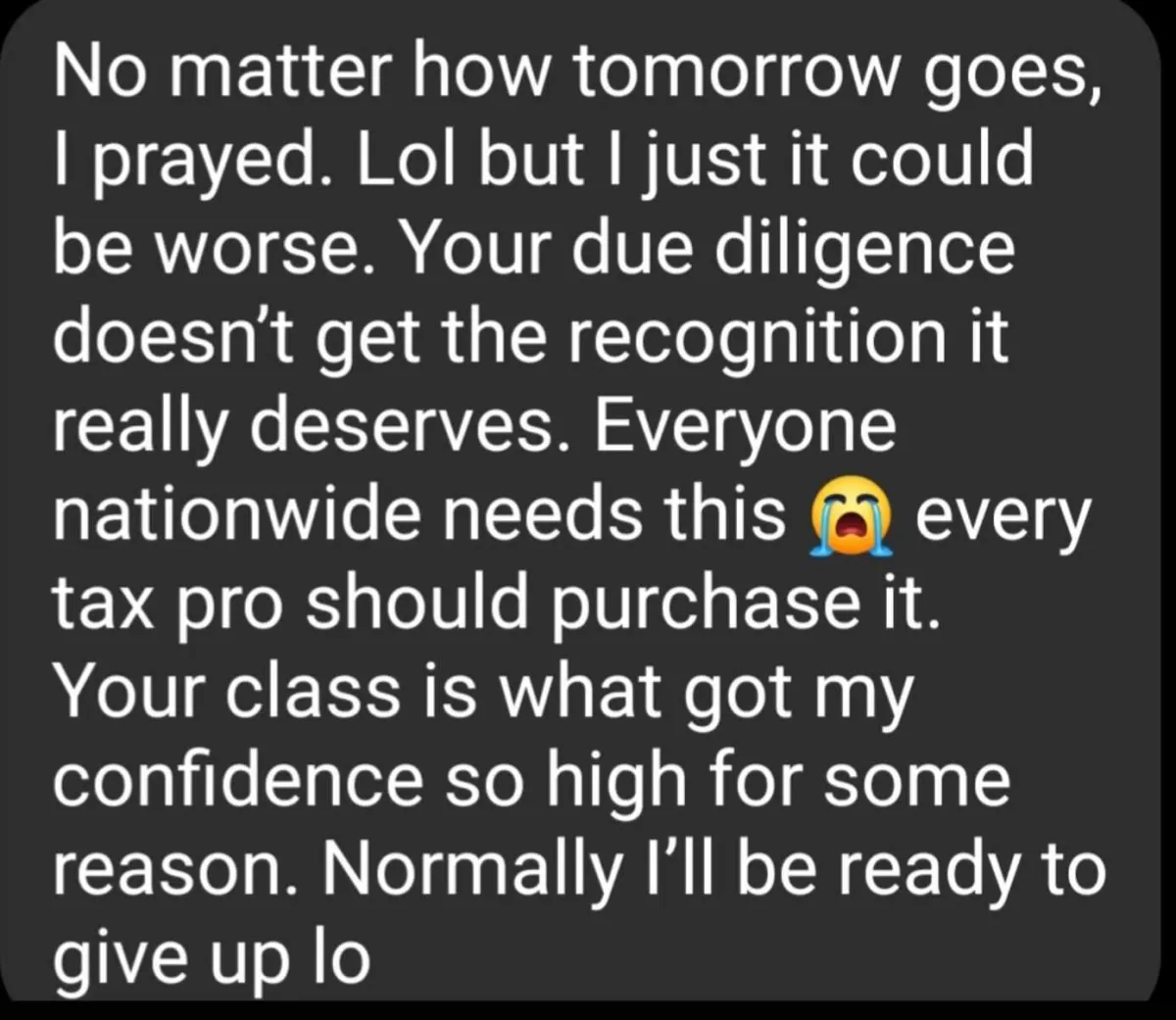

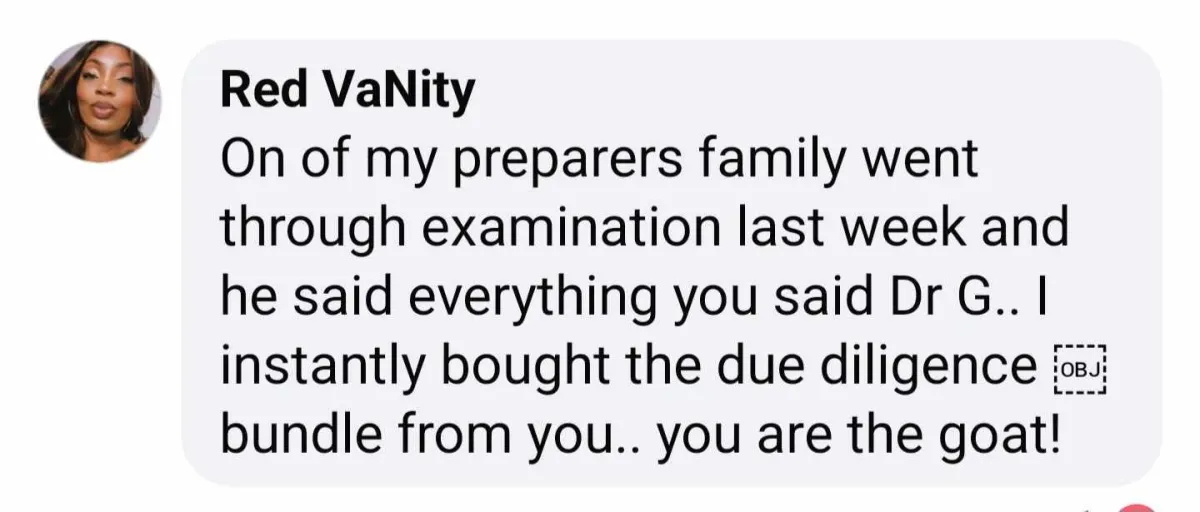

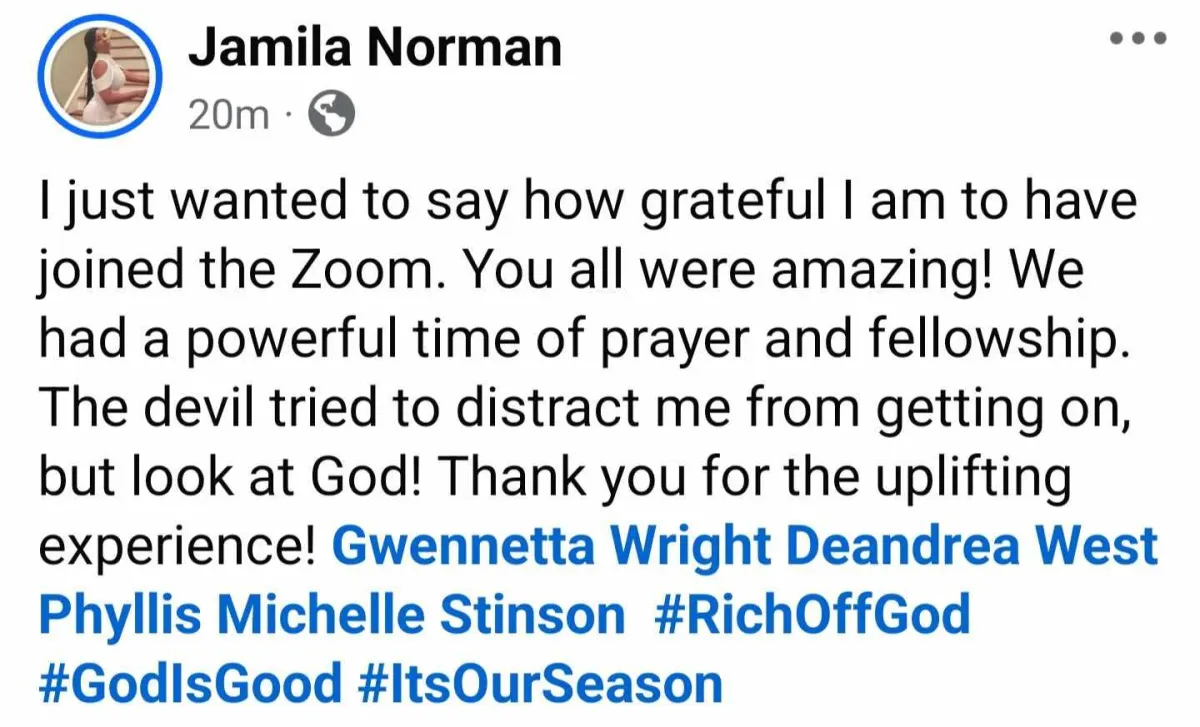

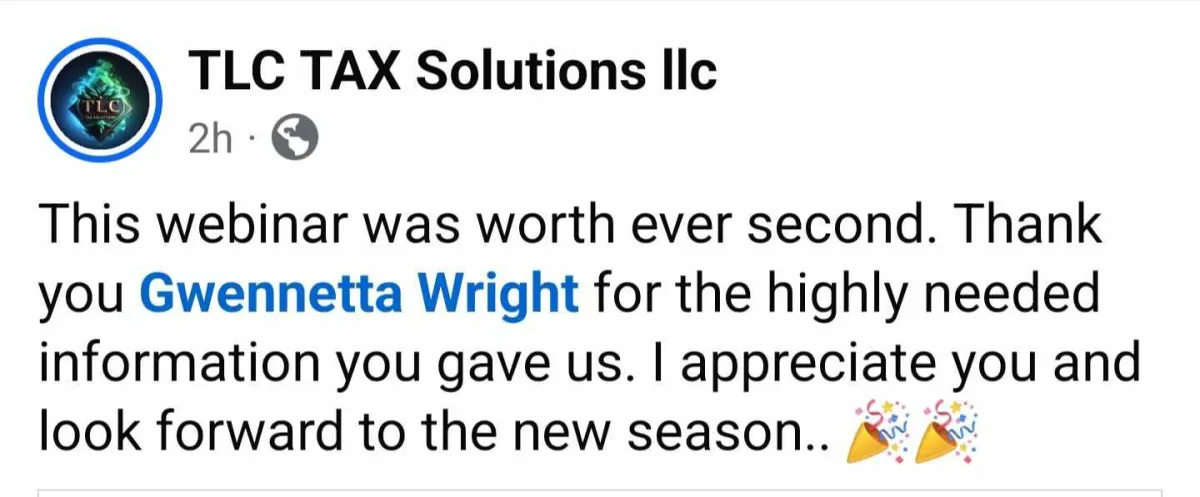

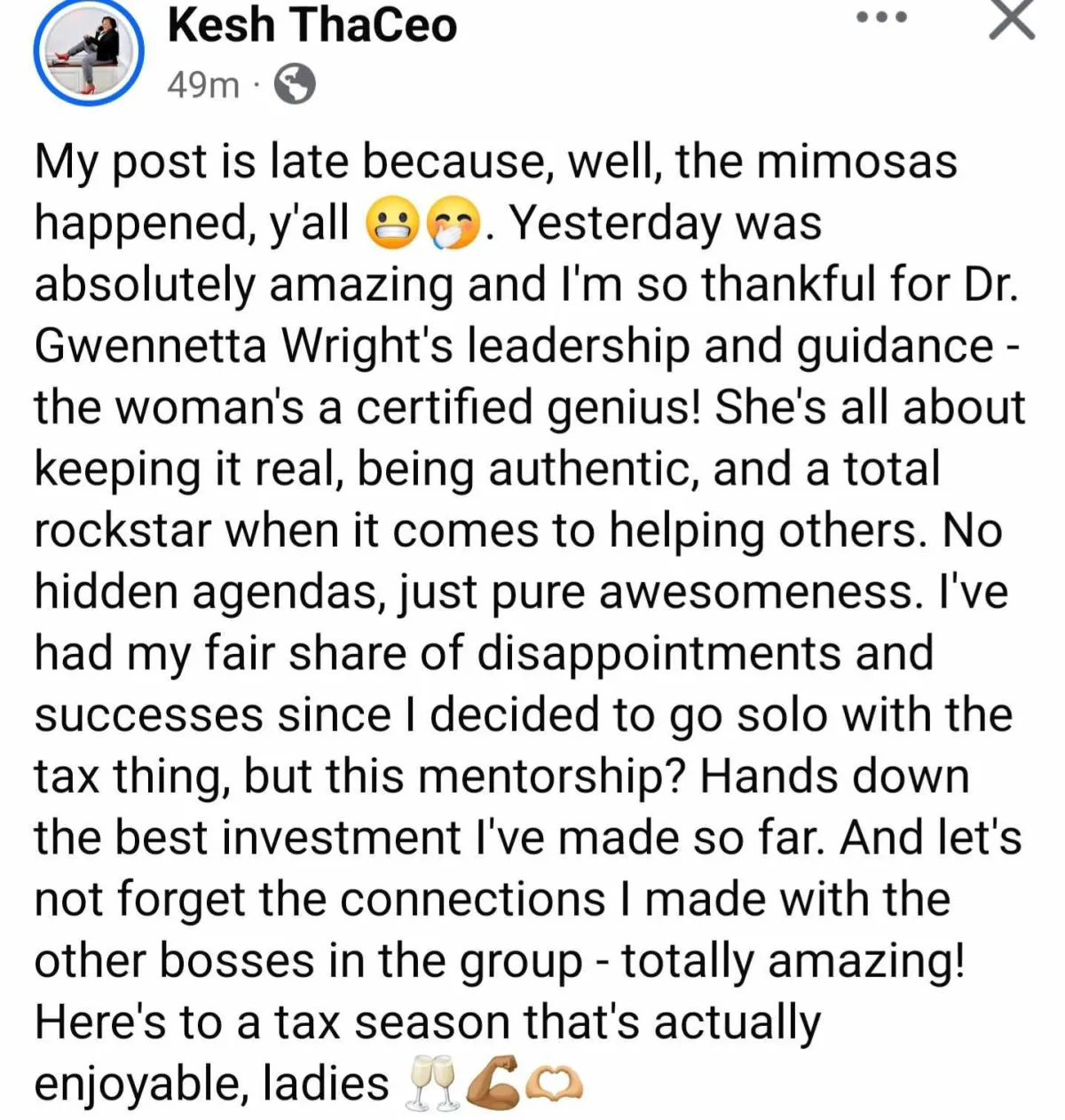

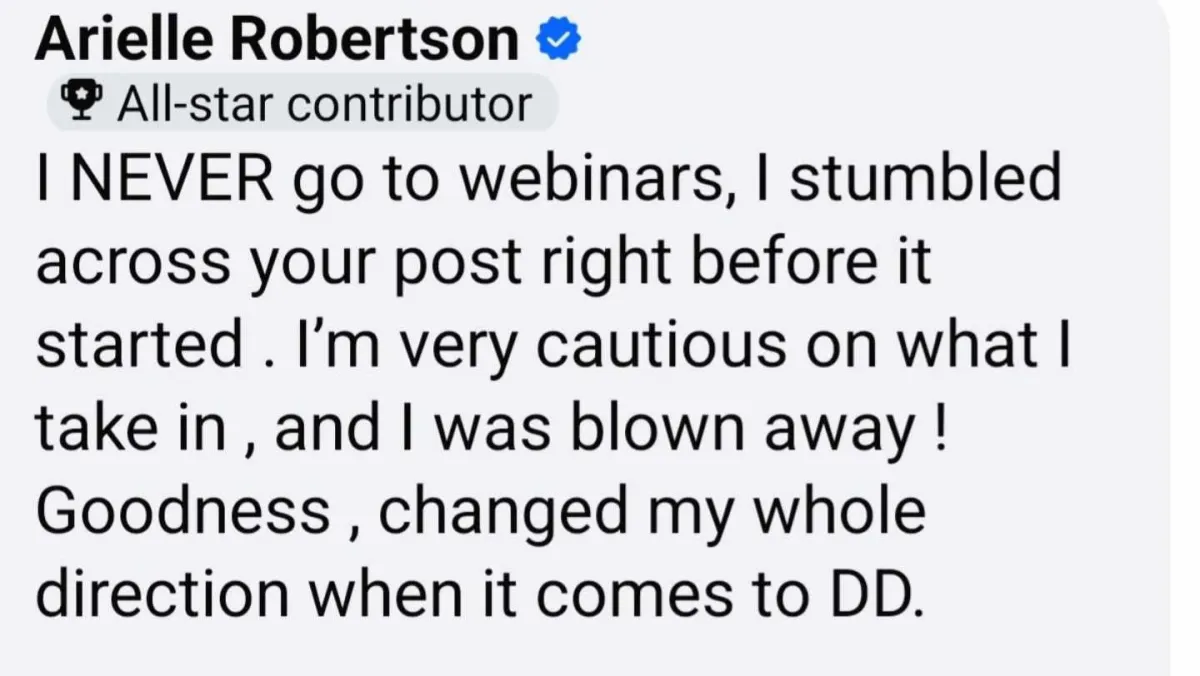

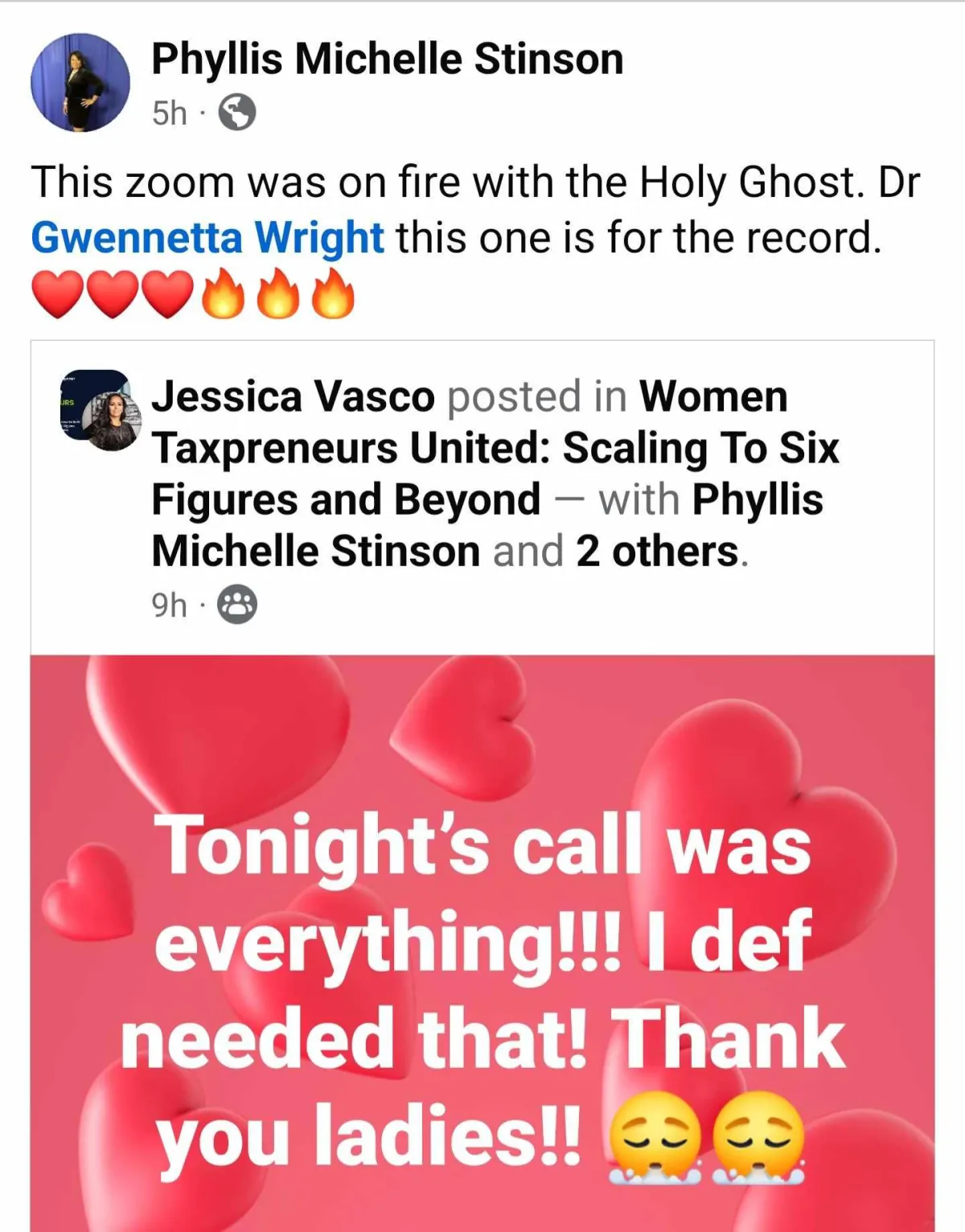

STRAIGHT FROM THE SOURCE

Hear directly how our Due Diligence Training has empowered tax professionals to avoid fines, stay compliant, and protect their businesses with confidence.

TESTIMONIALS

What others are saying

"Worth Every Minute"

"After attending the boot camp, I feel more confident than ever to bring everything I’ve learned back to my business and team—thanks to Dr. Gwennetta’s clear, down-to-earth guidance that made even complex compliance info easy to understand and apply."

"Truly Transformative"

"Her powerful insights on due diligence shifted my mindset and reminded me how crucial this topic is for business success. The experience was worth every dollar, from the invaluable networking to the wealth of knowledge shared by everyone in the room.

- Pamela Juarez

"Absolutely Worth It"

"I can confidently say this tax compliance class was absolutely worth it. Gwen is not a gatekeeper—she generously shares the knowledge you need to stay compliant before issues arise, making the investment of time and money more than worthwhile." - Crystal Hudson-Daniels

"Game-changer"

"Dr. Gwennetta helped shift my mindset around IRS audits, empowering me to know the law, protect myself, and stay compliant. I truly appreciate the clarity and confidence this class gave me, and if you’re in the tax industry, you absolutely need to be here." - CJ

Pricing & What’s Included

Admission: $699

Early Bird: $499

A Few Important Notes:

No children or pets allowed at the event

Brunch is for paid attendees only

Bring your laptop if you'd like, but it’s not required

Come ready to learn and network

Location:

Sonesta Atlanta Airport North 1325 Virginia Avenue, Atlanta, GA 30344

Frequently Asked Questions

1. Do you offer payment plans?

No, we do not offer payment plans. Full payment is required to secure your spot.

2. Will I receive templates or tools to help me?

Absolutely! You will receive templates and resources to help you implement what you learn in your own tax business.

3. What is the refund policy?

All sales are non-refundable and no chargebacks are allowed. Please make sure you’re ready to commit before purchasing.